Composition Levy – Section 10 of CGST Act

1. The Composition Scheme for small businesses has given to help them with maintaining minimum compliance.

2. This Composition Scheme will make compliance with tax laws hassle free for eligible businesses opting for the scheme.

3.The composition levy is an alternative method of levy of tax designed for small taxpayers whose turnover is up to Rs. 1.5 crore and pays a flat rate of tax regardless of what they manufacture, provide as a service or trade they carry on.

Conditions for Opting for Composition Scheme under GST:

The conditions for opting Composition scheme under GST are as follows:

No Credit of Input Tax

Any dealer registered under Composition Scheme will not be eligible to take credit of Input Tax credit on purchases. Also, the buyer of those goods will not get the credit of taxes paid.

No Inter-state business

The major drawback of this scheme is that the assessee cannot deal in interstate transactions or affect import – export of goods and services. He is barred from performing such actions which limit his territory for expansion and can only conduct local or intra state transactions.

Pay tax from own pocket

Since the dealer is not allowed to charge tax from his buyer, despite the rate being very low, he has to pay out of his own pocket. He is not even allowed to issue a tax invoice, resulting the burden on the assessee to pay tax.

Strict Penal provisions

Utmost care is required while taking benefit of composition levy under GST regime as the penal provisions are quite severe. If by any chance, it is proved that the assessee is wrongly registered under this scheme, not fulfilling the required criteria and thereby avoiding taxes will face bad consequences. He will be then be asked to pay taxes along

Question and Answer:-

1. Who can opt for Composition Scheme?

Businesses with annual turnover upto Rs 1.5 crore can opt for composition scheme.

Turnover of all businesses with same PAN has to be added up to calculate turnover for the purpose of composition scheme.

2. What is the tax rate applicable to a Composition Dealer?

Please see the chart below to understand the tax rate applicable:

3. I am purchasing goods from an unregistered dealer. Do I need to pay tax?

Tax at normal rates has to be paid on purchases from an unregistered dealer only for the months of July and August 2017. From September there is no need to pay tax on these purchases. No ITC is available on tax paid under reverse charge.

4. How should the Tax amount be calculated?

A composition dealer is required to pay tax at a specific rate on total sales.

9. Can a Composition Dealer collect tax from customers?

No, a Composition Dealer is not allowed to collect composition tax from the buyer.

The declaration of change can be submitted on the GST Portal.

12. I have many branches. Will composition scheme apply to each of them separately?

If Composition Scheme is opted for all businesses that are associated with this PAN

1. The Composition Scheme for small businesses has given to help them with maintaining minimum compliance.

2. This Composition Scheme will make compliance with tax laws hassle free for eligible businesses opting for the scheme.

3.The composition levy is an alternative method of levy of tax designed for small taxpayers whose turnover is up to Rs. 1.5 crore and pays a flat rate of tax regardless of what they manufacture, provide as a service or trade they carry on.

Conditions for Opting for Composition Scheme under GST:

The conditions for opting Composition scheme under GST are as follows:

a) The person opting for composition levy should be a registered person.

b) Aggregate turnover of registered person in the preceding Financial Year should not exceed Rs.1.5 crore.

c) Following class of registered persons would not be entitled to opt for Composition Scheme.

- person engaged in supply of services would not be eligible to opt for composition levy except for person engaged in supply of food for human consumption.

- Person making any supply of goods which are not leviable to tax under this Act. At present following goods are not leviable to tax under this Act:

¨ Petroleum Crude

¨ High Speed Diesel

¨ Motor Spirit

¨ Natural Gas

¨ Aviation Turbine Fuel

¨ Alcohol for Human Consumption

- Person making any inter-State outward supplies of goods.

- Person making any supply of goods through an electronic commerce operator who is required to collect tax at source under section 52.

- Person who is a manufacturer of such goods as may be notified by the Government on the recommendation of the Council.

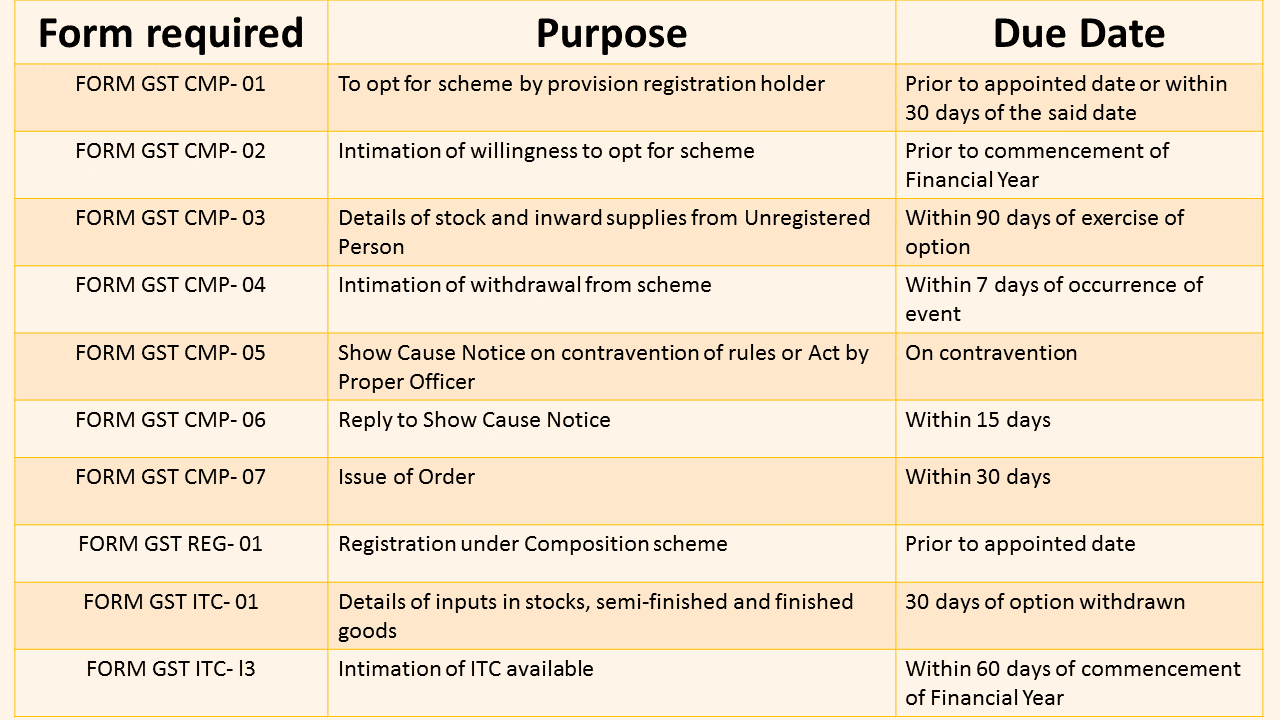

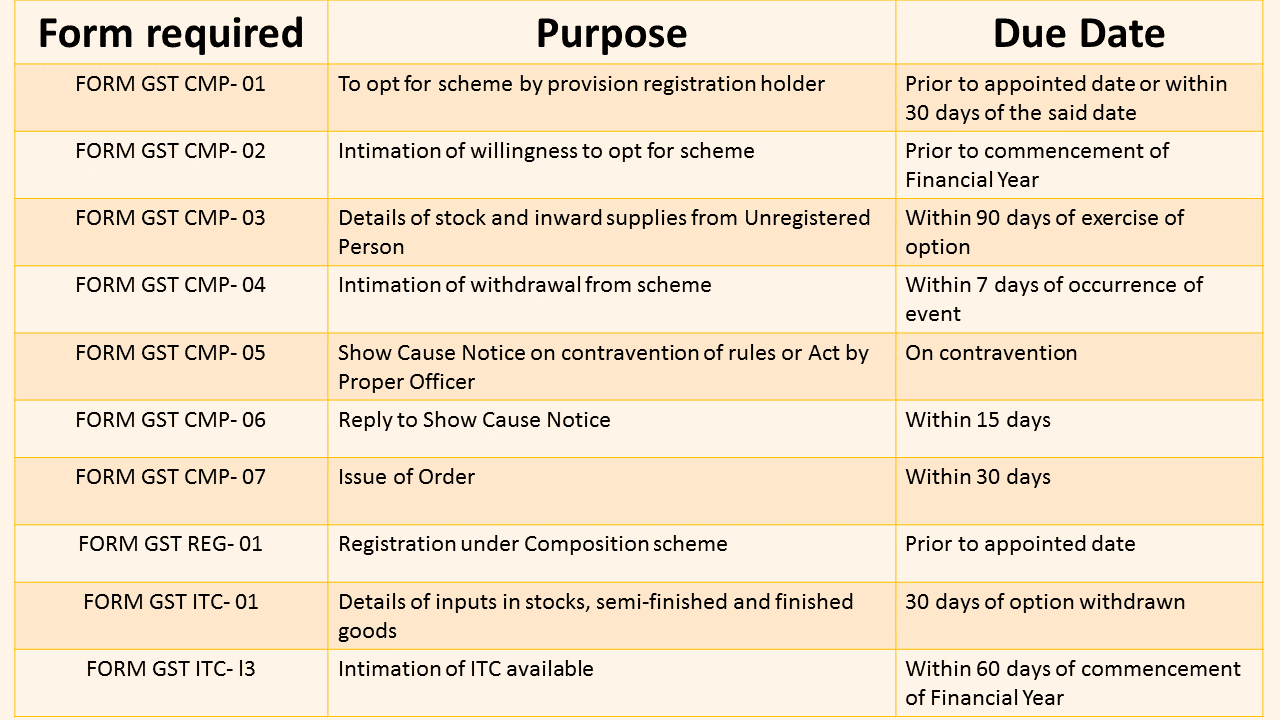

Composition Scheme forms

Composition Scheme Rules under GST provides for submission of different forms meant for respective purposes followed by due date for submission of such forms, which are as follows:

Limitations of GST Composition Scheme

There are some of the limitations that every business owner must be aware of:No Credit of Input Tax

Any dealer registered under Composition Scheme will not be eligible to take credit of Input Tax credit on purchases. Also, the buyer of those goods will not get the credit of taxes paid.

No Inter-state business

The major drawback of this scheme is that the assessee cannot deal in interstate transactions or affect import – export of goods and services. He is barred from performing such actions which limit his territory for expansion and can only conduct local or intra state transactions.

Pay tax from own pocket

Since the dealer is not allowed to charge tax from his buyer, despite the rate being very low, he has to pay out of his own pocket. He is not even allowed to issue a tax invoice, resulting the burden on the assessee to pay tax.

Strict Penal provisions

Utmost care is required while taking benefit of composition levy under GST regime as the penal provisions are quite severe. If by any chance, it is proved that the assessee is wrongly registered under this scheme, not fulfilling the required criteria and thereby avoiding taxes will face bad consequences. He will be then be asked to pay taxes along

Question and Answer:-

1. Who can opt for Composition Scheme?

Businesses with annual turnover upto Rs 1.5 crore can opt for composition scheme.

Turnover of all businesses with same PAN has to be added up to calculate turnover for the purpose of composition scheme.

2. What is the tax rate applicable to a Composition Dealer?

Please see the chart below to understand the tax rate applicable:

3. I am purchasing goods from an unregistered dealer. Do I need to pay tax?

Tax at normal rates has to be paid on purchases from an unregistered dealer only for the months of July and August 2017. From September there is no need to pay tax on these purchases. No ITC is available on tax paid under reverse charge.

4. How should the Tax amount be calculated?

A composition dealer is required to pay tax at a specific rate on total sales.

5. Should a Composition Dealer maintain detailed records?

No, a dealer registered under composition scheme is not required to maintain detailed records as required by a normal taxpayer.

6. Can Composition Dealers avail Input Tax Credit?

No, a Composition Dealer is not allowed to avail input tax credit of GST on purchases.

7. Can a Composition Dealer issue Tax Invoices?

A Composition Dealer has to issue Bill of Supply. They cannot issue a tax invoice. This is because the tax has to be paid by the dealer out of pocket. A Composition Dealer is not allowed to recover the GST from the customers.

8. What are the returns to be filed by a Composition Dealer?

The taxable person is required to furnish only one return i.e. GSTR-4 on a quarterly basis and an annual return in FORM GSTR-9A.9. Can a Composition Dealer collect tax from customers?

No, a Composition Dealer is not allowed to collect composition tax from the buyer.

10. Can a dealer involved in interstate supplies opt for Composition Scheme?

Composition Scheme is available only for dealers doing intra-state supplies. If a dealer is involved in inter-State supplies, then they have to opt out of the scheme.

11. Can I opt for Composition Scheme in one year and opt out in next year?

Yes, this is possible. You can opt to switch between the Composition Scheme and the normal scheme based on your turnover. However, you will have to keep in mind that this will affect the way you issue invoices and file your returns.The declaration of change can be submitted on the GST Portal.

12. I have many branches. Will composition scheme apply to each of them separately?

If Composition Scheme is opted for all businesses that are associated with this PAN

13. Is it true that Composition Dealers can sell a product at a lower price than regular dealers?

Yes. Composition dealers cannot charge GST on their sales. So the end consumer pays less money than usual.

No comments:

Post a Comment