Enterprise’s ProblemsAn enterprise faces a number of problems from its inception, through its life time and till its closure. We shall try to get a few insights about them from the following discussion.

Problems relating to objectives: As mentioned earlier, an enterprise functions in the economic, social, political and cultural environment. Therefore, it has to set its objectives in relation to its environment. The problem is that these objectives are multifarious and very often conflict with one another. For example, the objective of maximising profits is in conflict with the objective of increasing the market share which generally involves improving the quality, slashing the prices etc. Thus the enterprise faces the problem of not only choosing its objectives but also striking a balance among them.

Problems relating to location and size of the plant: An enterprise has to decide about the location of its plant. It has to decide whether the plant should be located near the source of raw material or near the market. It has to consider costs such as cost of labour, facilities and cost of transportation. Of course, the entrepreneur will have to weigh the relevant factors against one another in order to choose the right location which is most economical.

Another problem relates to the size of the firm. It has to decide whether it is to be a small scale unit or large scale unit. Due consideration will have to be given to technical, managerial, marketing and financial aspects of the proposed business before deciding on the scale of operations. It goes without saying that the management must make a realistic evaluation of its strengths and limitations while choosing a particular size for a new unit.

Problems relating to selecting and organising physical facilities: A firm has to make decision on the nature of production process to be employed and the type of equipments to be installed. The choice of the process and equipments will depend upon the design chosen and the required volume of production. As a rule, production on a large scale involves the use of elaborate, specialized and complicated machinery and processes. Quite often, the entrepreneur has to choose from among diuerent types of equipments and processes of production. Such a choice will be based on the evaluation of their relative cost and eflciency. Having determined the equipment to be used and the processes to be employed, the entrepreneur will prepare a layout illustrating the arrangement of equipments and buildings and the allocation for each activity.

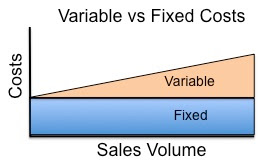

Problems relating to Finance: An enterprise has to undertake not only physical planning but also expert financial planning. Financial planning involves (i) determination of the amount of funds required for the enterprise with reference to the physical plans already prepared (ii) assessment of demand and cost of its products (iii) estimation of profits on investment and comparison with the profits of comparable existing concerns to find out whether the proposed investment will be profitable enough and (iv) determining capital structure and the appropriate time for financing the enterprise etc.

Problems relating to organisation structure: An enterpriseals of aces problems relating to the organisational structure. It has to divide the total work of the enterprise into major specialised functions and then constitute proper departments for each of its specialized functions. Not only this, the functions of all the positions and levels would have to be clearly laid down and their inter-relationship (in terms of span of control, authority, responsibility, etc) should be properly defined. In the absence of clearly defined roles and relationships, the enterprise may not be able to function eflciently.

Problems relating to marketing: Proper marketing of its products and services is essential for the survival and growth of an enterprise. For this, the enterprise has to discover its target market by identifying its actual and potential customers, and determine tactical marketing tools it can use to produce desired responses from its target market. After identifying the market, the enterprise has to make decision regarding 4 P’s namely,

Product: variety, quality, design, features, brand name, packaging, associated services, utility etc.

Promotion: Methods of communicating with consumers through personal selling, social contacts, advertising, publicity etc.

Price: Policies regarding pricing, discounts, allowance, credit terms, concessions, etc.

Place: Policy regarding coverage, outlets for sales, channels of distribution, location and layout of stores, inventory, logistics etc.

Problems relating to legal formalities: A number of legal formalities have to be carried out during the time of launching of the enterprise as well as during its life time and its closure. These formalities relate to assessing and paying diuerent types of taxes (corporate tax, excise duty, sales tax, custom duty, etc.), maintenance of records, submission of various types of information to the relevant authorities from to time, adhering to various rules and laws formulated by government (for example, laws relating to location, environmental protection and control of pollution, size, wages and bonus, corporate management licensing, prices) etc.

Problems relating to industrial relations: With the emergence of the present day factory system of production, the management has to devise special measures to win the co-operation of a large number of workers employed in industry. Misunderstanding and conflict of interests have assumed enormous dimensions that these cannot be easily and promptly dealt with. Industrial relations at present are much more involved and complicated. Various problems which an enterprise faces with regard to industrial relations are - the problem of winning workers’ cooperation, the problem of enforcing proper discipline among workers, the problem of dealing with organised labour and the problem of establishing a state of democracy in the industry by associating workers with the management of industry.

Goods and Service Tax Book (Updated upto 20th January 2018)

GST Student friendly Book most relevant/Useful for CA Intermediate/IPCC, CS executive , CWA Intermediate and CA final.

Also useful for B.Com / M.Com / MBA/ BBA/UPSC/ SSC and Various Govt Exams.!!

This book is approved by Ministry of HRD Govt.of India as Students friendly book.

Click on link given to Purchase Book- https://goo.gl/ArNFJx

Author Name- CA Harshita Raichandani and CA Dhananjay Ojha

Unique features of This GST Book.

1.80+ GST chart included for quick revision of chapter.

2.Provisions presented in this book in simple manner.

3.Bullet and Heading given for Long term memorisation.

4.Updated upto 25th GST council recommendation {18th January, 2018}.

5.70+ Value added questions given with answer.

6.16 Chapters fully Coverage given.

7.Definitions of Technical term related with GST is given at one place.

8.Most useful for CA Intermediate/IPCC, CS executive , CWA Intermediate and CA final. ALSO useful for B.Com / M.Com / MBA/ BBA/UPSC/ SSC and Various Govt Exams.

Click on below Link to purchase Student friendly GST Book.

http://www.comgurukul.com/educational-books/gst-book/

GST (Goods and Services Tax) Book -A student friendly Book. - Bharat Gurukul

GST Student friendly Book most relevant/Useful for CA Intermediate/IPCC, CS executive , CWA Inte