Modigliani- Miller Theory on Dividend Policy

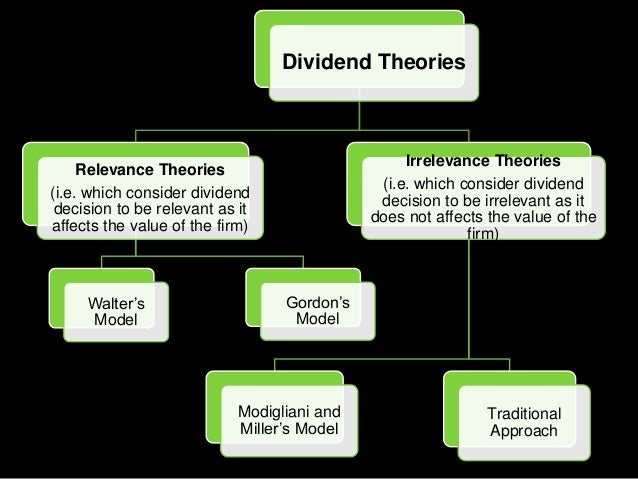

According to Modigliani and Miller (M-M), dividend policy of a firm is irrelevant as it does not affect the wealth of the shareholders. They argue that the value of the firm depends on the firm’s earnings which result from its investment policy

Miller theory firmly states that the dividend policy of a company has no influence on the investment decisions of the investors.

This theory also believes that dividends are irrelevant by the arbitrage argument. By this logic, the dividends distribution to shareholders is offset by the external financing. Due to the distribution of dividends, the price of the stock decreases and will nullify the gain made by the investors because of the dividends. This theory also implies that the cost of debt is equal to the cost of equity as the cost of capital is not affected by the leverage.

Thus, when investment decision of the firm is given, dividend decision the split of earnings between dividends and retained earnings is of no significance in determining the value of the firm. M – M’s hypothesis of irrelevance is based on the following assumptions.

1. The firm operates in perfect capital market

2. Taxes do not exist

3. The firm has a fixed investment policy

4. Risk of uncertainty does not exist. That is, investors are able to forecast future prices and dividends with certainty and one discount rate is appropriate for all securities and all time periods. Thus, r = K = Kt for all t.

Under M – M assumptions, r will be equal to the discount rate and identical for all shares. As a result, the price of each share must adjust so that the rate of return, which is composed of the rate of dividends and capital gains, on every share will be equal to the discount rate and be identical for all shares.

Thus, the rate of return for a share held for one year may be calculated as follows:

Where P^ is the market or purchase price per share at time 0, P, is the market price per share at time 1 and D is dividend per share at time 1. As hypothesised by M – M, r should be equal for all shares. If it is not so, the low-return yielding shares will be sold by investors who will purchase the high-return yielding shares.

This process will tend to reduce the price of the low-return shares and to increase the prices of the high-return shares. This switching will continue until the differentials in rates of return are eliminated. This discount rate will also be equal for all firms under the M-M assumption since there are no risk differences.

From the above M-M fundamental principle we can derive their valuation model as follows:

Multiplying both sides of equation by the number of shares outstanding (n), we obtain the value of the firm if no new financing exists.

If the firm sells m number of new shares at time 1 at a price of P^, the value of the firm at time 0 will be

The above equation of M – M valuation allows for the issuance of new shares, unlike Walter’s and Gordon’s models. Consequently, a firm can pay dividends and raise funds to undertake the optimum investment policy. Thus, dividend and investment policies are not confounded in M – M model, like waiter’s and Gordon’s models.

Criticism:

Because of the unrealistic nature of the assumption, M-M’s hypothesis lacks practical relevance in the real world situation. Thus, it is being criticised on the following grounds.

1. The assumption that taxes do not exist is far from reality.

2. M-M argue that the internal and external financing are equivalent. This cannot be true if the costs of floating new issues exist.

3. According to M-M’s hypothesis the wealth of a shareholder will be same whether the firm pays dividends or not. But, because of the transactions costs and inconvenience associated with the sale of shares to realise capital gains, shareholders prefer dividends to capital gains.

4. Even under the condition of certainty it is not correct to assume that the discount rate (k) should be same whether firm uses the external or internal financing.

If investors have desire to diversify their port folios, the discount rate for external and internal financing will be different.

5. M-M argues that, even if the assumption of perfect certainty is dropped and uncertainty is considered, dividend policy continues to be irrelevant. But according to number of writers, dividends are relevant under conditions of uncertainty.

Commerce Gurukul

for test series of upsc commerce optional and for weekend classes of upsc commerce optional at Gonda and New Delhi

Contact at - commercegurukulca@gmail.com

link to join telegram - t.me/commerce_optional

Commerce Gurukul

for test series of upsc commerce optional and for weekend classes of upsc commerce optional at Gonda and New Delhi

Contact at - commercegurukulca@gmail.com

link to join telegram - t.me/commerce_optional

No comments:

Post a Comment